The ongoing issue of liquid crystal display (LCD) oversupply — exacerbated by China’s aggressive investment in production capacity as well as high fab utilization — will continue well into 2016.

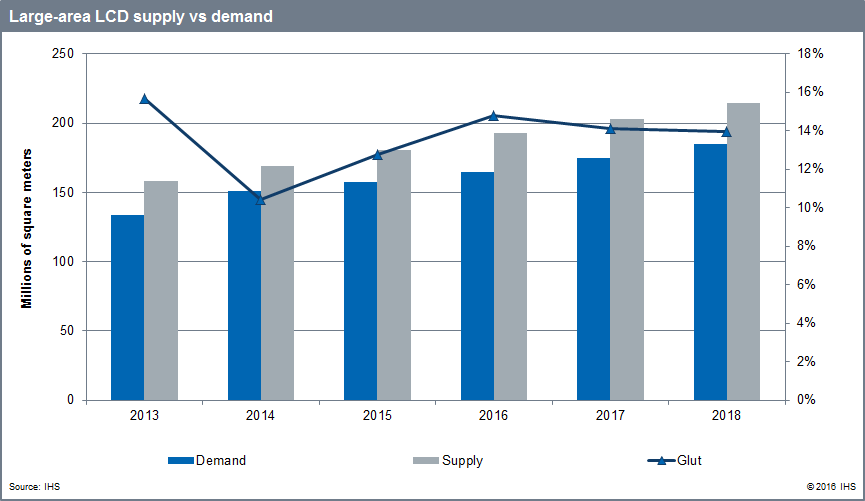

The supply of large-area LCD is expected to be 14 percent greater than demand in 2016, up from 12 percent in 2015, according to IHS.

Chinese LCD suppliers are maintaining high manufacturing targets and expanding capacity, partly thanks to Chinese government subsidies for startup and infrastructure costs.

On the other hand, LCD TV demand, particularly in Russia, Brazil and other emerging countries, has not grown as expected, because of currency depreciation and slow economic recovery.

“Panel prices have declined to the degree where the break-even point for manufacturers was reached in the fourth quarter of 2015,” said Yoshio Tamura, displays director for IHS Technology.

“Panel prices have declined to the degree where the break-even point for manufacturers was reached in the fourth quarter of 2015,” said Yoshio Tamura, displays director for IHS Technology.

“Due to declining value of currencies in emerging countries, demand for higher priced LCD TVs will not rebound in 2016. Even so, Chinese panel makers are not planning to lower fab utilization anytime soon to expand market share, which means large-area LCD manufacturers will be in the red in 2016.”

“Even so, Chinese panel makers are not planning to lower fab utilization anytime soon to expand market share, which means large-area LCD manufacturers will be in the red in 2016.”

Chinese LCD suppliers are expected to adjust fab utilisation in the middle of 2016, according to the IHS Display Supply Demand & Equipment Tracker, and LCD oversupply will be eased in the second half of 2017.

“If Chinese manufacturers don’t lower their fab utilisation within 2016, there will be an even greater negative impact on global LCD suppliers’ profit margins,” Tamura said.