‘The core concept of the channel is fragmenting, as audience behavior is changing and broadcasters are adapting to meet evolving viewer needs’

‘The core concept of the channel is fragmenting, as audience behavior is changing and broadcasters are adapting to meet evolving viewer needs’

The traditional TV channels business is entering a period of flux, according to new analysis released today by IHS Inc.

“The core concept of the channel is fragmenting, as audience behavior is changing and broadcasters are adapting to meet evolving viewer needs,” said Ted Hall, research director at IHS Technology. “The traditional linear channel will be around for a long time to come, but it will become increasingly marginalised by a plethora of online services, from catch-up TV to TV Everywhere, pay TV channels’ streaming offerings and YouTube multi-channel networks.”

Traditional channels circumvent established distributor partners

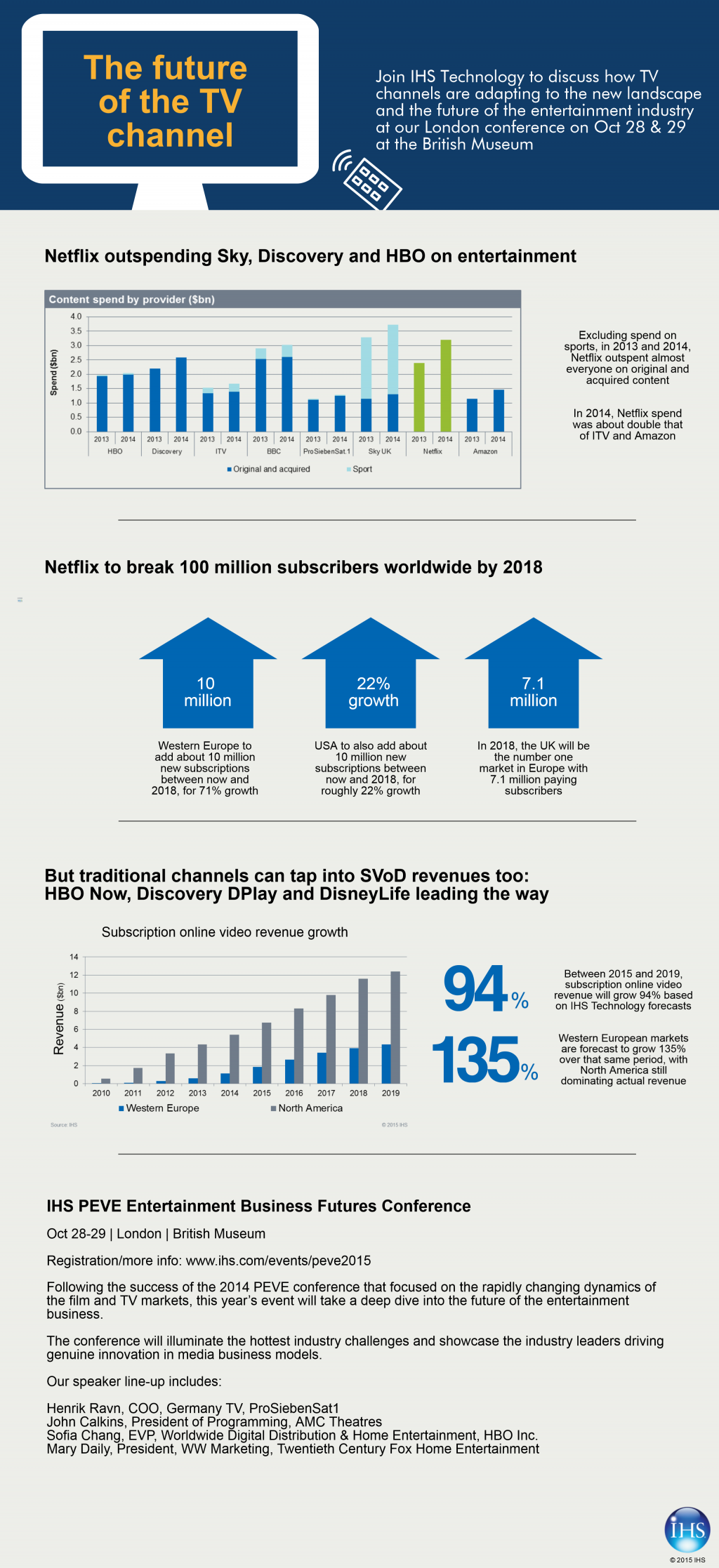

Direct to Consumer (D2C) offerings are emerging as key new services for traditional channels. “HBO Now, Discovery DPlay and DisneyLife are leading the way and employing a strategy that not only gives them more power in carriage-fee negotiations, but also allows them to grab their piece of the growing online-subscription revenue pie,” Hall said.

Specter of Netflix – 100 million subscribers by 2018

The growing popularity of Netflix is a major factor spurring channels’ D2C launches. “Excluding spend on sports, in 2013 and 2014, Netflix outspent almost everyone on original and acquired content. In 2014, Netflix’s content spend was about double that of ITV and Amazon,” Hall said.

In 2018, Netflix will pass 100 million subscribers worldwide according to IHS Technology. “Between now and 2019, we forecast subscriptions will grow by 22 percent, with 10 million new subscribers to be added in the US,” said Dan Cryan, senior director Media & Content at IHS Technology.

“International subscribers are key for Netflix,” Hall said. “As Netflix invests more in international content, we expect to see huge growth in Western Europe over the next three years, with 10 million new subscribers to be added to its already burgeoning international base.”

The UK will be the number one market in Europe for Netflix, with 7.1 million paying subscribers by 2018.